Investment and financial management

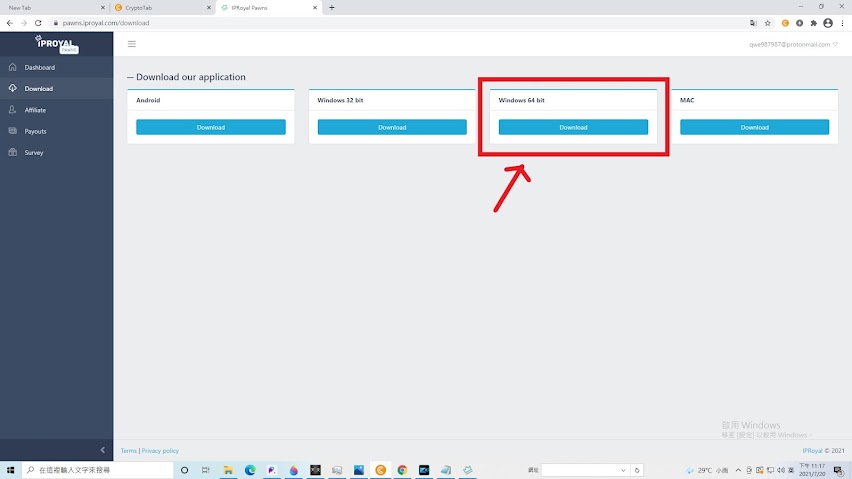

[ IPRoyal 挂机赚钱 ] | 2021年网赚 被动收入 | 连睡觉也可以赚钱,不需要投入任何金额,也不需要点击广告!

网赚 | [ CrypotTap挂机赚钱 ] 2021年被动收入 | 连睡觉也可以赚钱,不需要付出任何金额,也不需要点击广告!

[ CryptoTap挂机赚钱 ] | 2021年网赚 被动收入 | 连睡觉也可以赚钱,不需要付出任何金额,也不需要点击广告!

是否入金:不需要投入金額

網址鏈結:https://cryptotabbrowser.com/14240210

出金圖:

網站介紹:

72 rules of investment

72 rules of investment

> Compound interest is beyond imagination

The power of compound interest is best explained with an example. If you invest 5,000 yuan a month in a fund with an average annual return rate of 15%, the net value of the fund will reach 150 million after 40 years. Usually when you hear this number, you will mistakenly think that if you follow this condition, you will get 75 million in 20 years of investment. It turned out that it was not like that, but only about 7.5 million yuan, a full difference ten times faster!

Will cause such a result, of course, this is because of the effect of compound interest.However, through the sight of the 72 law, you can clearly see the future of the dragon.

> 72 is a magic number

Will it take a few years to double the amount invested? That is, no matter what the investment amount is, it will be twice that amount. For example, an investment of 100 yuan will become 200 yuan, an investment of 100,000 yuan will become 200,000 yuan, and of course an investment of 100 million yuan will also become 200 million yuan. The magic number of 72 gives a super perfect answer. The number of years required to double the investment is equal to "72" divided by the "return on investment". There are no complicated formulas and no exponential calculations, just such a simple formula, you can get the answer with mental arithmetic. Although this answer is not precise or approximate, it is sufficient as an investment decision.

For example, if the return on investment is 10%, it will take 7.2 years to double (=72/10); if the return on investment is 15%, the doubling time can be shortened to 4.8 years (=72/15).

> Doubled in 5 years is of great significance

A 15% rate of return on investment can double the amount of investment every 5 years. This is not trivial. It is equivalent to the accumulated amount that can be earned in this lifetime every 5 years. When you are reading this article, if you already have a wealth of 10 million, this is what you have accumulated for a lifetime until now. However, as long as another five years, you can easily earn another 10 million yuan, of course, provided that there is a 15% return every year. This seems to take a lifetime of wealth, which can now be earned in only 5 years, and it will double all the way. This also shows that whoever gets the first pot of gold in life earlier is the best portrayal of the winner.

This also states that the sooner you get rich, the more you will get richer in the future. And when you get older and cannot make money on your own, the money you have can continue to bring wealth. The supreme realm of financial management: When you travel to Paris and have coffee on the left bank leisurely, your money is still working hard to help you make money.

> The meaning of compound interest

Understanding the rule of 72 and the effect of compound interest cannot bring wealth "immediately", but it clearly conveys an important message that the rate of return on investment is very important and determines whether you have wealth in the "future". Think about it if A and B have 1 million at the same time at the age of 30, A will only deposit 2%, but B’s return on investment is 15%. When he retires at the age of 65, he uses the 72-rule mental arithmetic and A 100 Million can only double to 2 million. However, B's 1 million is doubled every 5 years, and it can be doubled 7 times in 35 years, which is 128 times the 7th power of 2 which is equivalent to 128 million. To be A or B, you decide for yourself!

The terrible compound interest

The terrible compound interest

Einstein once said: "The greatest energy in the universe is compound interest" and "The power of compound interest is far greater than the atomic bomb." These are just Internet rumors, and there is no record showing that Einstein said that although compound interest is important, it is not so great!

Compound interest is just to keep the profit and continue to be used as the principal investment in the next period. The rate of return on investment is the real key. The true meaning of rate of return is growth rate, and compound interest is the concept of compound growth rate. To make funds grow rapidly, the decisive factor is of course the growth rate.

First review the term growth rate. Growth rate measures the growth or decline of a group of numbers in a certain period, such as one-year population growth rate, monthly revenue growth rate or decline rate, weekly net worth growth rate, etc. The period can be one day, one month or one year at any time. Calculated as follows:

Growth rate = (end of period-beginning of period) / beginning of period

The end of the period minus the beginning of the period is the difference of the current period, a positive value represents growth, and a negative value represents recession. The difference divided by the beginning of the period is the growth rate or the decline rate. For example, a certain city had a population of 100,000 at the beginning of the year, and by the end of the year it had a population of 110,000, which was 10% more than the population at the beginning of the year, so the population growth rate for that year was 10%. In terms of investment and financial management, the calculation formula of return on investment is as follows:

Return on investment = (amount at the end of the period-amount invested at the beginning of the period) / amount invested at the beginning of the period

It can be seen that it is exactly the meaning of the growth rate, so the rate of return on investment can also be regarded as the rate of capital growth, which is the ratio of the amount invested at the end of the period more than the amount invested at the beginning of the period. If 100,000 yuan is invested at the beginning of the period, the amount at the end of the period is 120,000 yuan, so the capital is more than 20,000 yuan, and the return on investment is equal to 20%. It can also be seen that the amount invested at the end of the period has increased by 20% compared with the amount invested at the beginning of the period.

If the growth part of each period is retained, the growth that continues in the next period is called the compound growth rate. If the beginning quantity is PV, the ending quantity is FV, and the growth rate is g, after n periods, the formula for calculating the ending quantity of compound growth is:

FV = PV*(1+g)n

Compound interest is actually the concept of compound growth rate, so as long as the growth rate g in the above formula is replaced by the rate of return r, it becomes the final net value (FV) formula of compound interest:

FV = PV*(1+r)n

For example, with an investment of 100,000 yuan at the beginning of the period, the rate of return on investment is 20% per year, and the net value after 40 years is 146,977,157 yuan [=100000*(1+20%)^40], which is equivalent to 1,470 times the investment amount. This kind of capital explosion makes many people think that compound interest is really great. But is this caused by the power of compound interest? If the annual rate of return is only 1%, the net value after 40 years of compound interest is only 148,886 yuan. This shows one thing. The real protagonist of capital growth is the rate of return on investment, while compound interest is only a supporting role.

To put it simply, compound interest means that the profit of each period is not taken away, and the principal of the next period is continued to be invested, which is the concept of profit rolling. Compound interest starts with the bank’s interest calculation. As long as the principal and interest continue to be deposited after the bank’s fixed deposit expires, it can have compound interest effects. However, the current annual interest rate is only about 1%, and of course there will be no explosive growth. So the rate of return is not large enough. What is compound interest? neither.

If the rate of return on investment is 10% per year, and if you invest 100,000 yuan, you can make a profit of 10,000 yuan per year. Even if you invest in simple profit, you can take away the profit of 10,000 yuan per year and you will not continue to invest. 40 years will be accumulated. With a profit of RMB 10,000, the sum of principal and interest at the end of the period is RMB 500,000, which is far more than the compound interest of 1%, which proves that the rate of return on investment is the key, and compound interest only accelerates growth.

Since the rate of return is so important, the return on investment must be as high as possible. The problem is that the higher the rate of return, the higher the relative risk, that is, the greater the volatility. The amounts in Table 1 are all calculated at a fixed rate of return. For the 20% column, a fixed rate of return of 20% every year is actually impossible to achieve, because the actual rate of return will not be the same every year. Equivalent to no risk. Risky assets, such as stocks or bonds, have a higher rate of return because they take risks. Statistically dealing with the different rates of return each year, the average rate of return and standard deviation are generally used to describe the standard deviation. The standard deviation is the degree to which the annual rate of return deviates from the average rate of return. The larger the standard deviation, the greater the degree of fluctuation each year.

Conclusion: Regardless of whether it is a stock or bond fund, you can find the standard deviation data, and you can evaluate the possible future net worth of holding such a target. Compound interest is just to make profits and then invest again. The rate of return on investment is the key, but the higher the average rate of return, the greater the degree of volatility and the higher the uncertainty in the future. Even so, long-term holding can still be rewarded. Next time, don't ask what kind of target has compound interest effect. Trying to find a higher average rate of return is the best strategy.

《EOS靈境殺戮》風車平原(LV73~73) 怪物掉落

《EOS靈境殺戮》風車平原(LV73~73) 怪物掉落

平原雞怪LV73

平原雞怪LV73

靈魂石強化捲軸

技能書(高級治癒)

暗黑暗殺者LV73

暗黑暗殺者LV73

士兵的短褲 靈魂石強化捲軸 布

帝國騎士的匕首

龍騎士腰帶 敢死隊褲子

暗黑劍士LV73

暗黑劍士LV73

騎士團鎧甲 銀 傭兵腿部護甲 發光的鑰匙

騎士腰帶 維京鞋子

聖騎士團之紋長劍 執政官內甲

突變狼LV73

突變狼LV73

無資料

凱基斯戰鬥魔法師LV73

凱基斯戰鬥魔法師LV73

憤怒法杖

紅血騎士團法杖 大魔法師長袍

凱基斯大槌戰士LV73

凱基斯大槌戰士LV73

騎士團下衣

搜查隊褲子 維京內甲 維京手套

暗殺團長褲子

拉塔LV73

拉塔LV73

奢華力量項鍊 先進的魔法防御手鏈

稀有製作書 技能書(狂戰士) 稀有防禦手環 龍騎士手套

英雄製作書 巴嵐鎧甲 拉塔鎮魂劍 拉塔短劍

《EOS靈境殺戮》地下遺跡B3層(LV72~73) 怪物掉落

地下遺跡B3層(LV72~73) 怪物掉落

地下遺跡靈魂蜘蛛 LV72

地下遺跡靈魂蜘蛛 LV72

皮革

大魔法師短褲 王室搜查隊短劍

地下遺跡地精狙擊手 LV72

地下遺跡地精狙擊手 LV72

防具強化捲軸 騎士團上衣

高級敏捷手環

龍騎士下衣

地下遺跡強化地精 LV73

地下遺跡強化地精 LV73

鐵 士兵短褲

魔力短劍

守護騎士鞋子 王室搜查隊隊褲子 技能書(靈活)

地下遺跡古代斯卡爾雷頓 LV73

地下遺跡古代斯卡爾雷頓 LV73

鐵

稀有防禦戒指

安格拉魔法師 LV73

安格拉魔法師 LV73

騎士團短褲 士兵頭盔

高級魔法防禦手環

大魔法師短褲 賢者長袍

噬魂者融合體 LV73

噬魂者融合體 LV73

受祝福的武器強化捲軸 靈魂石再次賦予卷軸

稀有製作書 賢者腰帶

亞卡泰戰鬥短褲 雷金腰帶 英雄製作書

《EOS靈境殺戮》古代巨岩怪之山(LV64~66) 怪物掉落

古代巨岩怪之山(LV64~66) 怪物掉落

古代風之精靈 LV64

古代風之精靈 LV64

靈魂石強化卷軸

高級藍寶石 高級力量項鍊 魔力耳環

龍騎士頭盔 稀有生命項鍊 守護魔法師法杖

混亂的巨岩怪 LV65

混亂的巨岩怪 LV65

馬里耶的糖果

龍騎士腿部護甲

風之巨岩怪 LV66

風之巨岩怪 LV66

高級敏捷項鍊

稀有生命項鍊 敢死隊褲子

風之巨岩怪戰士 LV66

風之巨岩怪戰士 LV66

紫水晶 藍寶石 貓眼石

高級敏捷手環

龍騎士手套 守護騎士之弓

雍恩 LV66

雍恩 LV66

防禦耳環

稀有製作書

英雄防禦耳環 英雄防禦戒指 英雄製作書